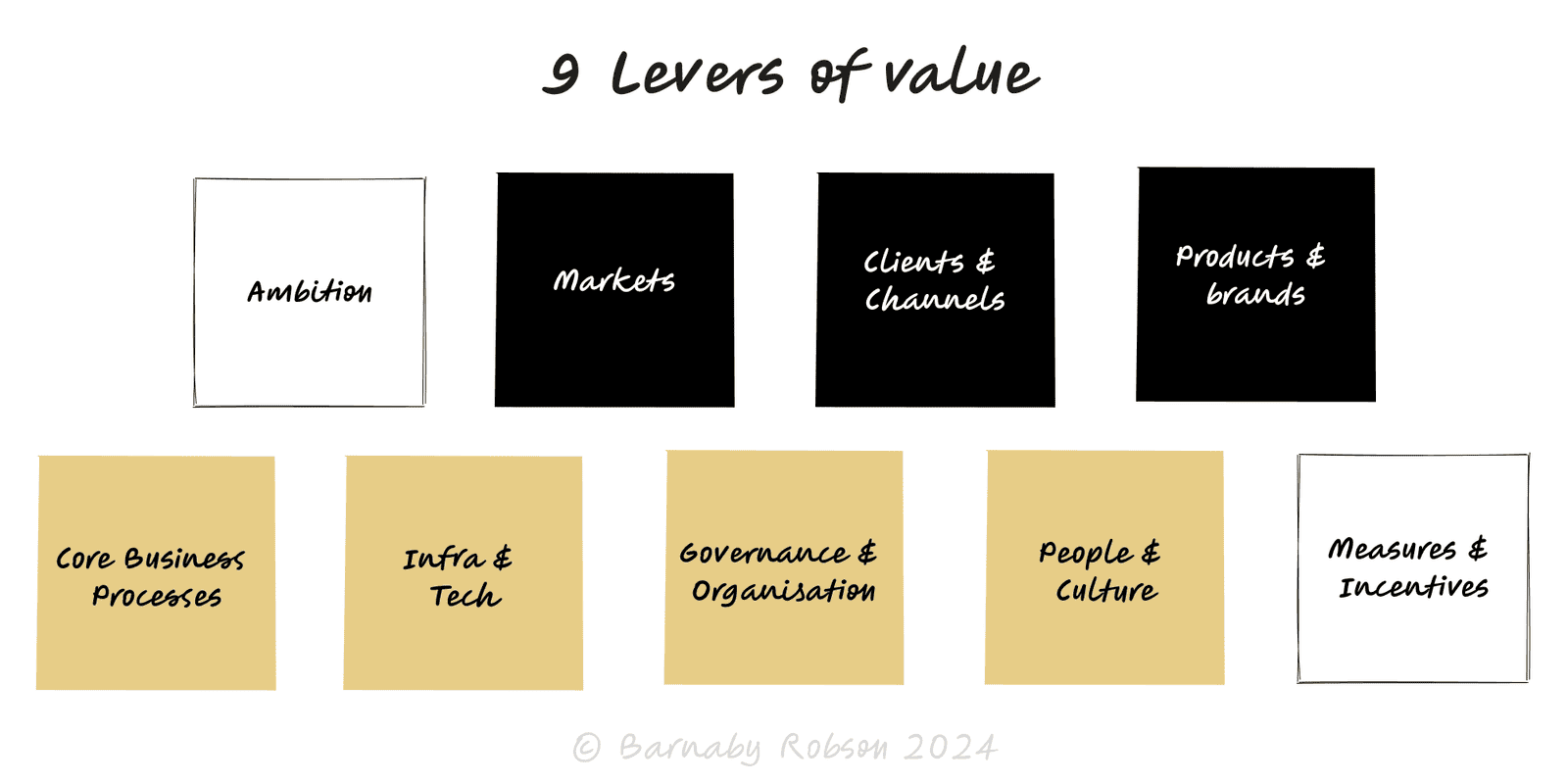

9 Levers of Value

KPMG

KPMG’s 9 Levers of Value is a holistic map for value creation. It aligns financial ambition with the choices in your business model and the capabilities of your operating model. Used well, it prevents “strategy in PowerPoint, operations in reality” by making the drivers of enterprise value explicit and executable.

Three layers

Financial model (aim) – target outcomes, risk appetite, capital structure, and strategic priorities.

Business model (where to play) – markets, customers/channels, and propositions & brands.

Operating model (how to win) – processes, technology & infrastructure, organisation & governance, people & culture, and measures & incentives.

The nine levers

Ambition (Financial outcomes) – revenue, margin, cash, capital structure, risk profile, non-financial outcomes.

Markets – geographies, industry structure, competitive/geo-political dynamics, regulation.

Customers & Channels – segments, routes to market, sales effectiveness, experience and loyalty.

Propositions & Brands – value propositions, portfolio mix, pricing & promotion, brand health.

Core Business Processes – supply chain, service delivery, sourcing/outsource, automation and benchmarking.

Technology & Infrastructure – systems, data, analytics, security, facilities and platforms.

Governance & Organisation – legal/entity design, decision rights (RACI), assurance, risk controls.

People & Culture – leadership, skills, hiring/retention, behaviours and culture change.

Measures & Incentives – KPIs/KRIs, dashboards, targets, compensation and non-financial rewards.

Value-creation plans (PE/VC, turnarounds, scale-ups).

Annual strategy and budgeting linked to execution.

Post-merger integration and synergy tracking.

Board packs that tie initiatives to valuation drivers.

Commercial/operational due diligence checklists.

Set ambition – define financial and non-financial outcomes, risk appetite, and constraints.

Map the current state – brief diagnosis for each lever; capture baselines and pain points.

Generate initiatives – 2–3 material options per lever; estimate impact, cost, time, and risk.

Prioritise – rank by expected value × feasibility; cut or stage low-leverage ideas.

Design the operating model – org, processes, tech, and governance that enable the chosen business model.

Assign owners & metrics – convert into OKRs/KPIs with clear DRIs and review cadence.

Sequence and fund – roadmap with dependencies, capex/opex, and decision gates.

Checklist thinking – lots of activity, little value; always link to valuation drivers.

No baselines – improvements can’t be proven or steered without starting metrics.

Mis-sequencing – building capabilities before strategic choices, or vice versa.

Incentive mismatch – KPIs and pay that fight the strategy.

Capability delusion – designing a target model that current skills/processes can’t deliver.

Over-engineering – heavy artefacts; keep it visual and decision-oriented.