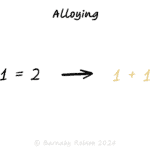

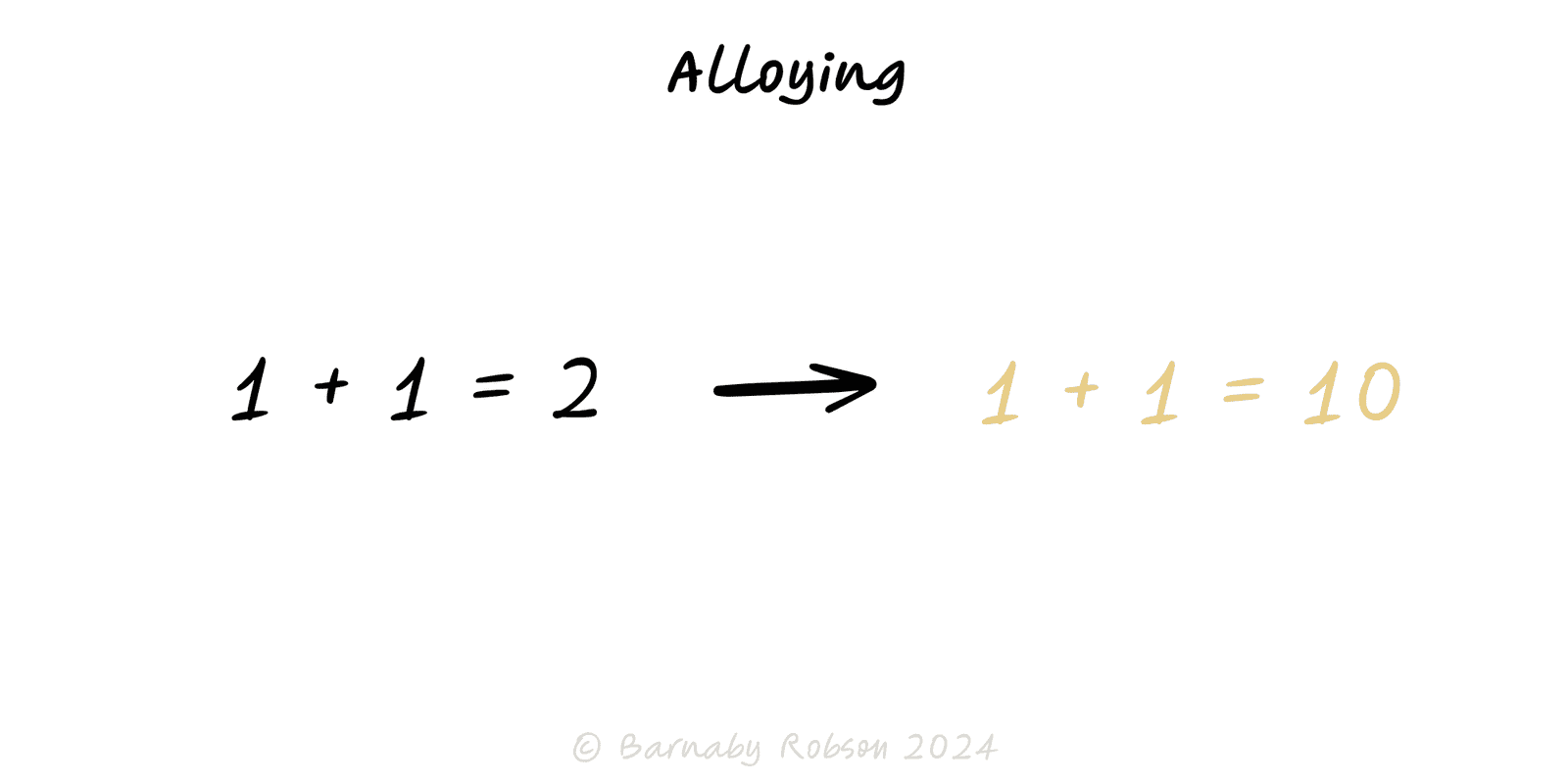

Alloying

General usage; metaphor from metallurgy (bronze, steel) applied to strategy and design

In metallurgy, mixing metals creates an alloy with properties neither metal has alone (e.g., hardness, corrosion resistance). Strategically, alloying means combining capabilities, assets or products so they interact and unlock value that stand-alone pieces cannot. Think hardware + software + services, content + community, or distribution + product. The point is complementarity and the interfaces that let pieces reinforce one another.

Complementarity – returns are super-additive when A increases the payoff of B (and vice-versa).

Interfaces – clear contracts between parts (APIs, SLAs, processes) reduce friction and let the combo behave like one thing.

Thresholds – some gains appear only after a completeness level (e.g., bundle breadth, data volume, network density).

Economies of scope – shared inputs (brand, data, logistics) lower unit cost across multiple outputs.

Risk mix – diversified cashflows and counter-cyclical pairs reduce volatility and cost of capital.

Bottlenecks – the combo performs at the pace of the weakest link; elevate the constraint.

Product strategy – bundle complements (device + cloud backup; analytics + workflow).

Go-to-market – marry strong distribution with a distinctive product; partner where you lack a channel.

Platforms/ecosystems – third-party apps or data that increase core value and lock-in.

M&A and alliances – map capability fit and post-deal operating model before the cheque.

Org design – cross-functional pods (design + engineering + ops) that ship faster than silos.

Brand & pricing – bundles and memberships that raise ARPU and retention.

Define the target property you want the alloy to have (e.g., higher LTV, lower churn, faster cycle time).

Inventory assets/capabilities you and partners possess; list complements and gaps.

Hypothesise combinations and quantify the interaction value (not just sum of parts).

Design the interfaces – data, process, API, incentives, and ownership; decide make/partner/buy.

Prototype a thin slice of the combo; measure uplift vs stand-alone (conversion, ARPU, NPS, cost).

Scale or stop – if uplift clears integration cost and complexity, standardise; if not, unbundle.

Wishful synergy – counting the same benefit twice or ignoring integration costs.

Integration tax – brittle coupling, unclear ownership, culture clash post-deal.

Cannibalisation – bundles that erode profitable stand-alone lines.

Over-bundling – added parts that customers don’t value increase cost and confusion.

Regulatory/contract limits – data sharing, exclusivity, or antitrust can block the alloy.

Neglected bottlenecks – one weak component caps the whole; fix the constraint first.