Anti-Fragility

Nassim Taleb

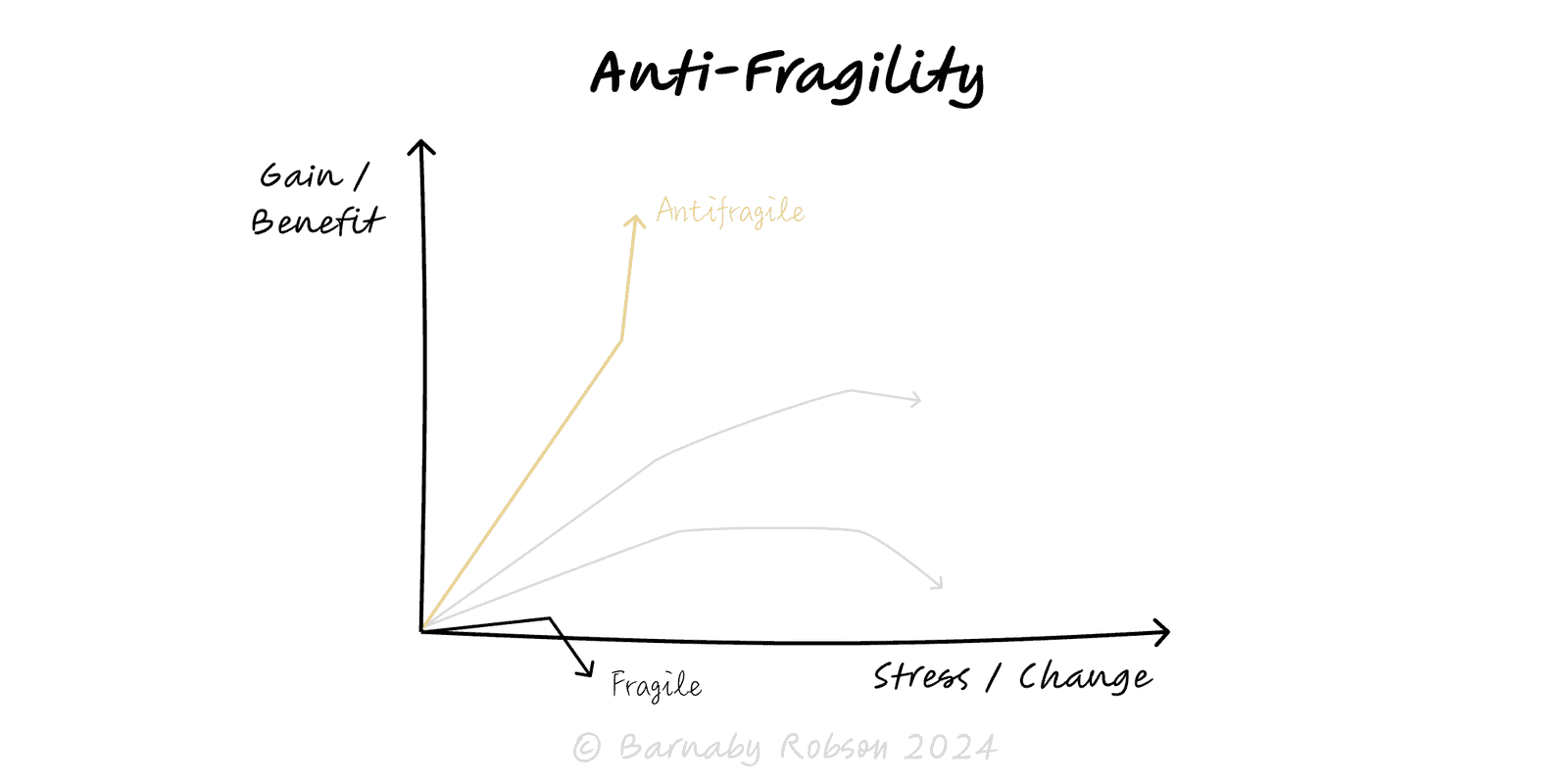

Anti-fragility is the opposite of fragility.

Fragile things are harmed by variability.

Robust things resist it.

Anti-fragile things benefit from disorder because their pay-offs are convex (bounded downside, open upside).

Taleb’s idea converts risk management from prediction to positioning: cap ruin, keep options, let small errors teach, and allow upside to compound.

Convex pay-offs – small losses, occasional large gains; seek payoff asymmetry.

Optionality – many low-cost options; few commitments; easy to exit.

Barbell portfolio – most resources in very safe assets/processes, a small slice in high-upside experiments.

Redundancy & slack – spare capacity and second sources prevent cascade failure.

Via negativa – remove things that add fragility (debt, tight coupling, single points of failure).

Skin in the game – decision-makers share downside, so feedback is honest.

Small batch evolution – run varied, reversible trials; keep what works, drop what doesn’t.

Investing & treasury – barbell positioning; avoid leverage-driven ruin.

Product & growth – many small experiments with fast kill/scale rules.

Operations & supply chain – buffers, dual sourcing, decoupling, chaos-testing.

Technology – microservices, feature flags, circuit breakers, autoscaling.

Org design – autonomous teams, clear ownership, post-mortems that change systems.

Personal routines – incremental load (hormesis), diverse income, low fixed costs.

Map fragility – list where variance hurts vs helps; identify ruin risks.

Cap the downside – add margin of safety, redundancy, and limits; ban single points of failure.

Create options – modular architecture, supplier alternatives, testable feature flags, talent benches.

Use a barbell – 80–90% in safe/core delivery; 10–20% in high-convexity bets.

Remove fragilisers – cut debt, over-tight SLAs, hidden coupling, hero-only processes.

Stress and learn – inject safe stressors (game days/chaos tests), log overrides, and adapt rules.

Align incentives – ensure owners feel both upside and downside (“skin in the game”).

Chasing volatility – not all noise is opportunity; measure convexity first.

No ruin cap – upside without hard loss limits leads to blow-ups.

Correlation in the tails – a “barbell” that crashes together isn’t a barbell.

Excess redundancy – slack without purpose just burns cash; target the constraint.

Experiment sprawl – options have carrying costs; enforce kill criteria and learning capture.

Regulatory & safety limits – some domains require predictability over optionality.