Churn

General usage in subscription and SaaS analytics

Churn is the rate at which customers or revenue are lost over time. Because recurring models compound, small changes in churn transform LTV, ARR and CAC payback. Treat churn as a system problem: acquisition quality, time-to-value, product habit, support, billing and contract structure all interact.

Definitions

- Logo churn – customers lost in a period ÷ customers at period start.

- Revenue churn – MRR/ARR lost from churned or downgraded accounts.

- Gross churn – revenue lost ignoring expansion.

- Net revenue retention (NRR) – (Start MRR − Contraction − Churn + Expansion) ÷ Start MRR. NRR > 100% implies “negative churn”.

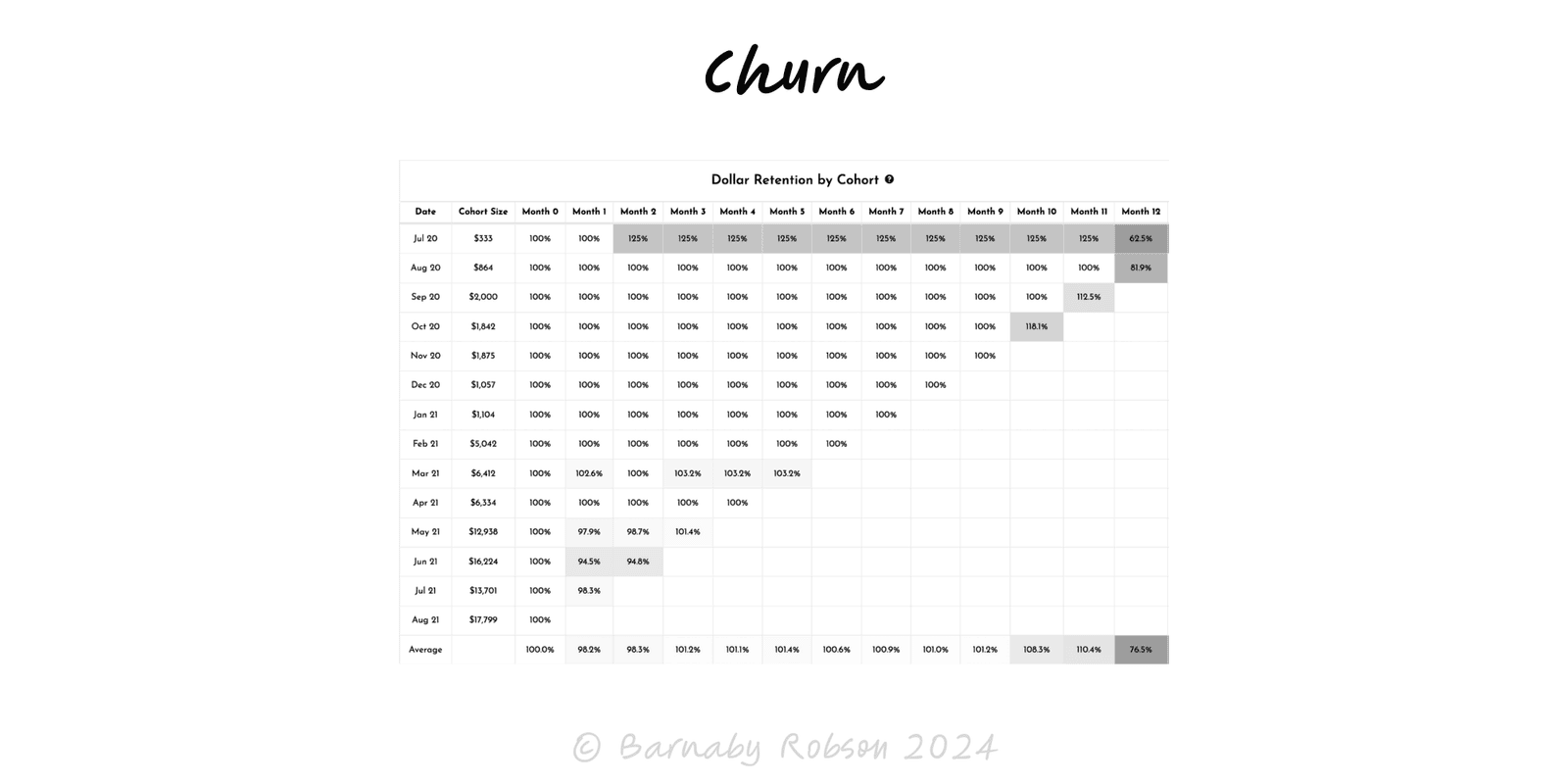

Cohorts, not snapshots – track groups by start month and follow survival curves. Early-life churn often dominates.

Hazard over time – the risk of cancelling is highest at specific moments: after trial, first billing, renewal.

Voluntary vs involuntary – cancellations vs payment failures/expired cards. Fixes differ.

Mix effects – plan length (monthly vs annual), segment, region and product skew averages.

Contraction – downgrades reduce revenue without a logo loss; include it in revenue churn.

Growth accounting – Growth = New + Expansion − Contraction − Churn.

SaaS and subscriptions – reduce early-life drop-off, increase adoption depth, engineer expansion.

Marketplaces and fintech – seller or user inactivity as churn; reactivation plays.

Media and communities – habit formation, content cadence, membership benefits.

B2B renewals – health scoring, QBR discipline, multi-threaded relationships.

Get the maths right

Standardise formulas. Separate logo, gross, net, and contraction. Report monthly and annual.

Build cohort tables and 12-month survival curves; identify where the curve bends.

Instrument the journey

Leading indicators: activation rate, time-to-value, weekly active use, feature adoption, support wait time, NPS/CSAT, payment failure rate.

Segment hard

By acquisition source, plan, size, vertical, region, product, tenure. Find the segments with outsized hazard.

Design interventions

Early-life: guided onboarding, checklists, in-product tours, first-value moments, concierge set-up.

Habit: usage triggers, calendars, defaults, templates, integrations, community.

Billing: dunning flows, card updater, multiple payment methods, grace periods, pause plan.

Renewal: success plans, QBRs, multi-threading, ROI reviews, annual options.

Test and measure

A/B save offers and flows; measure retained 90-day revenue, not just immediate saves.

Engineer expansion

Seat-based, usage-based, add-ons, tier upgrades. Expansion cushions churn and can lift NRR > 100%.

Close the loop

Capture structured churn reasons; run monthly reviews; turn the top 3 reasons into roadmap or ops fixes.

Vanity NRR – masking churn with one-time expansions. Track gross churn alongside NRR.

Mixing apples and pears – blending monthly and annual plans or segments hides truth.

Counting reactivations as never churned – report reactivation separately; don’t rewrite history.

Treating involuntary as voluntary – payment failures need dunning and card-updater, not product changes.

Discount addiction – saves today that poison willingness to pay tomorrow.

No cohort view – point-in-time rates miss early-life cliffs and seasonality.

Single-threaded accounts – one champion leaves and the logo follows; build breadth.