Disruptive Innovation

Clayton M. Christensen (1995 onwards)

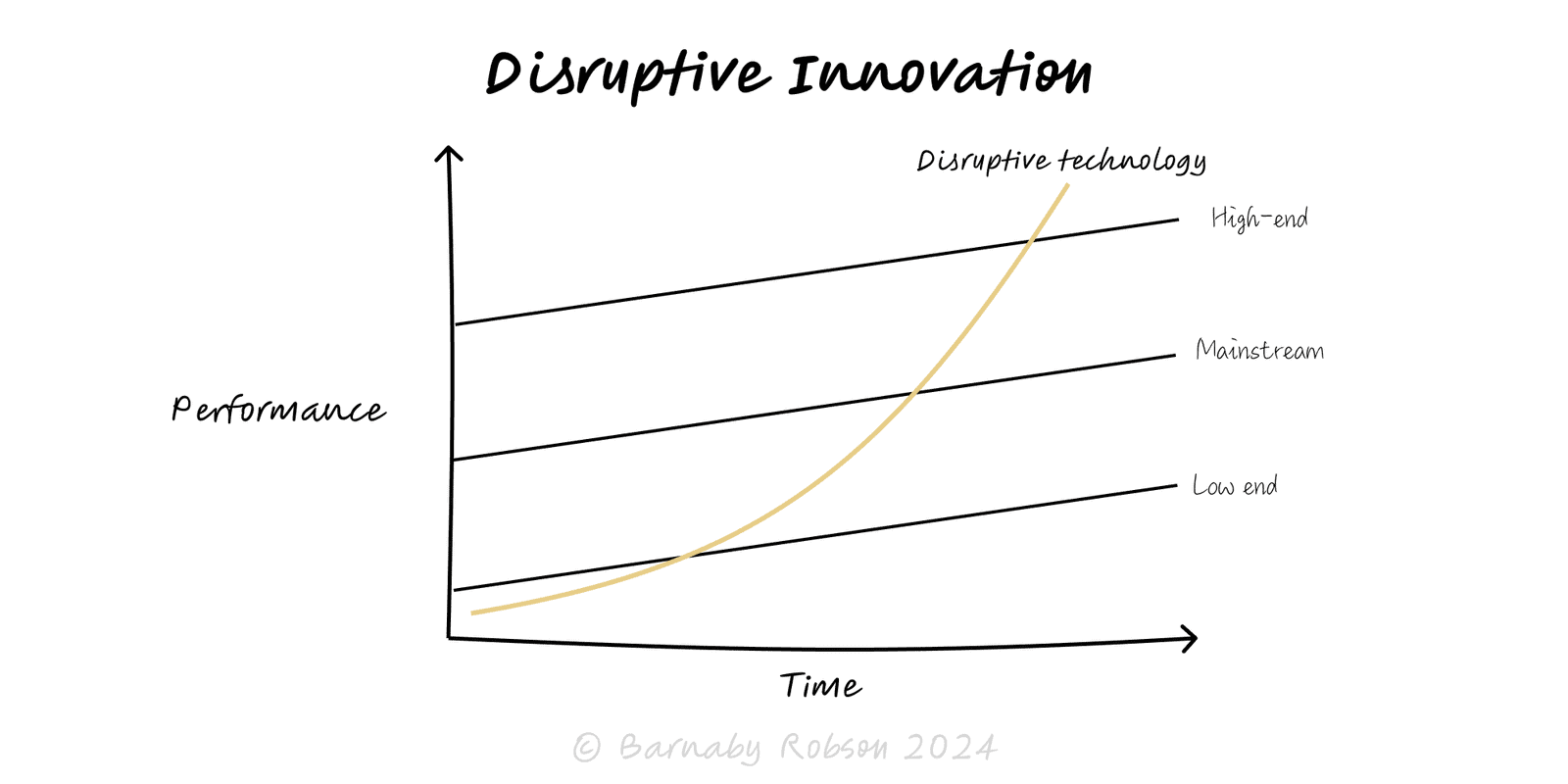

Christensen’s theory explains why strong incumbents lose to scrappy entrants. Incumbents improve performance for their best customers (sustaining innovation) and often overshoot what mainstream users need. Disruptors enter with a low-cost model that serves non-consumption or over-served buyers on new dimensions (price, convenience, access). As the technology and model improve, they climb the market, capturing the core before incumbents can respond without breaking their own economics.

Two footholds

- Low-end – target over-served customers with “good-enough” at far lower cost.

- New-market – unlock use where none existed (simpler, more convenient, cheaper).

Different performance trajectory – worse on legacy metrics at first, better on new ones (convenience, affordability, ease).

Business model asymmetry – lower cost structure and margins make the entrant’s market unattractive to incumbents.

Move upmarket – capability improves, price holds; entrants eat the core.

Value network shift – new channels, complements and partners fit the entrant; incumbents are tied to the old network.

Sustaining vs disruptive – sustaining helps incumbents serve existing customers; disruptive changes the basis of competition.

Software – SaaS vs on-prem; Google Docs vs Office; Figma vs desktop suites.

Media – streaming vs DVDs/cable; short-form vs broadcast.

Finance – fintech wallets/neobanks serving the unbanked or fee-averse.

Retail – D2C brands bypassing wholesale; low-cost stores.

Transport & travel – low-cost airlines; ride-hailing vs dispatch.

Find non-consumption or over-served users – list jobs-to-be-done where current offers are too costly/complex.

Define “good-enough” – choose the new metric you’ll win on (access, convenience, price, time).

Design the asymmetric model – low CAC channels, simplified product, cheaper support, different margins/targets.

Protect it organisationally – separate P&L, pricing and roadmap from the core to avoid “sustaining” gravity.

Launch a wedge product – narrow job, low price, high convenience; instrument adoption and unit economics.

Climb deliberately – add capabilities only when they lift your new metric and keep cost advantage; stage entry into mainstream segments.

For incumbents – set up an autonomous unit with permission to disrupt your own economics; pick customers who value the new metric.

Test disruptibility – Are customers over-served? Is there non-consumption? Can we build at much lower cost? Will incumbents be unmotivated to follow?

Calling every success “disruption” – high-end breakthroughs that help incumbents are sustaining, not disruptive.

Starving the unit – forcing core margin targets/pricing on a disruptive venture kills it.

Channel conflict – legacy sales incentives block the new model; real separation is required.

Feature creep – adding incumbent features erodes cost advantage; guard “good-enough”.

Wrong foothold – if no non-consumption/over-served segment exists, it’s not a true disruptive play.

Regulatory/quality cliffs – some domains require incumbent-grade performance from day one.