Fat Protocol Thesis

Joel Monegro (Union Square Ventures, 2016)

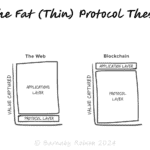

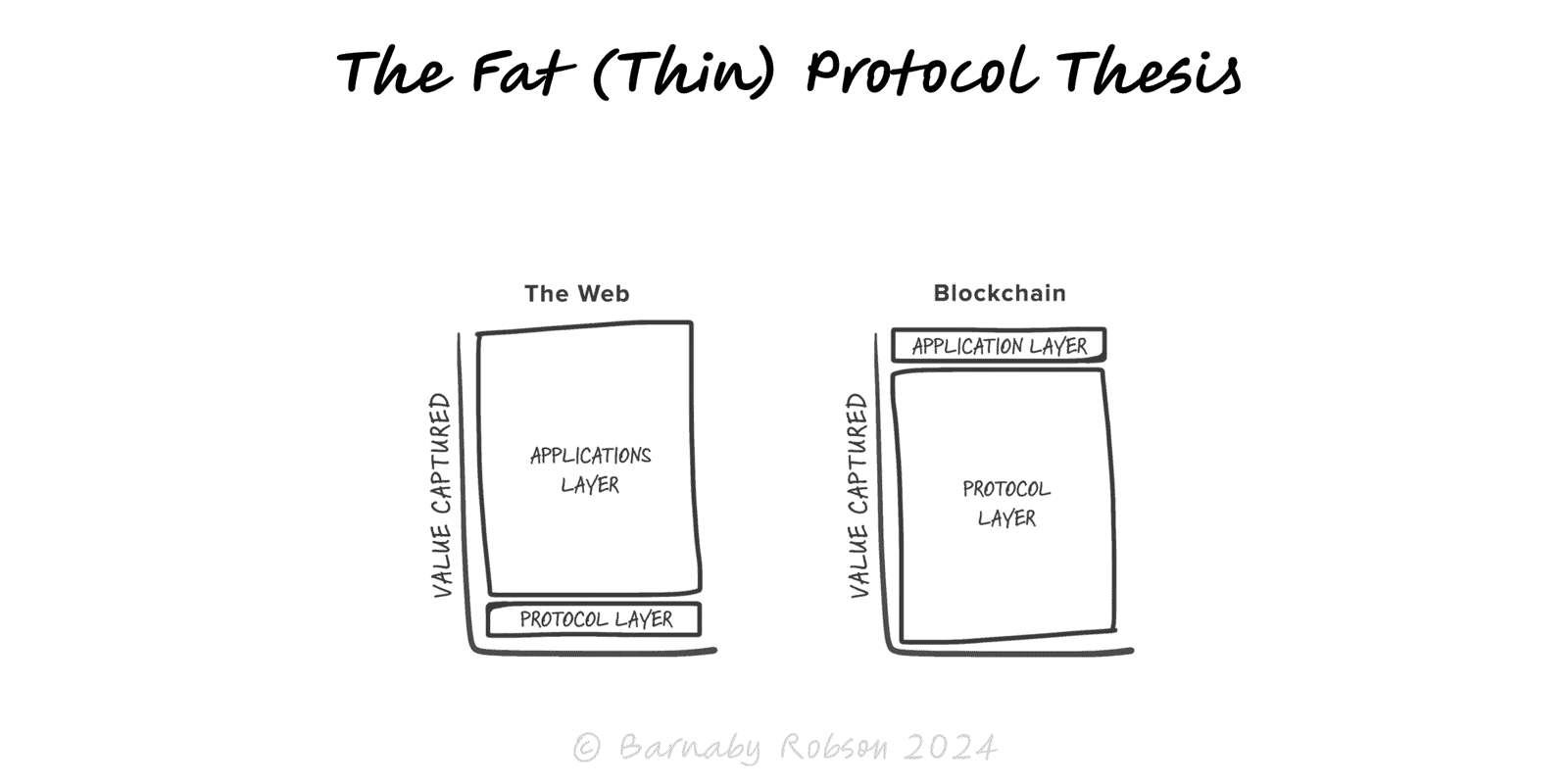

The Fat Protocol Thesis argues that blockchains invert the old Internet pattern of thin protocols, fat apps: because protocols have native tokens and a shared data/state layer, they capture more of the ecosystem’s value than any single application built on top. Think Bitcoin or Ethereum accruing value as usage and assets build on them.

Shared state as the moat – data and assets live at the protocol, so apps are interchangeable front ends on the same ledger, compressing their ability to capture value vs the protocol.

Tokenised coordination – a protocol token links users, developers and operators; rising usage can bid up token value and fund more building (security, grants, liquidity).

Composability – open smart contracts stack like Lego; when apps plug into one another, the base network and core protocols gain cumulative demand.

Price discovery at the base – markets form first in protocol tokens (and core DeFi protocols), so value is marked at the base layer earlier and more transparently than for individual apps.

Founder strategy – decide whether your edge is a protocol (shared state, liquidity, security) or an application (UX, distribution, niche workflows).

Token design – align contributors and secure the network; choose fee, burn, staking or revenue-share mechanisms carefully.

Investment theses – when to hold base protocols vs “fat apps”, or baskets of core money/settlement/compute protocols.

Ecosystem building – grants, standards, and dev tooling that deepen protocol lock-in via composability.

Map the stack – L1/L2, core protocols (AMMs, lending, oracles), and app/front ends in your domain.

Ask “where will value accrue?” – will users pay for shared liquidity/security/state (protocol) or for experience/distribution (app)?

Design capture mechanisms – for protocols: issuance, fees/burns, staking rewards, governance rights; for apps: take-rate, premium features, hosted services.

Measure real traction – not just token price; track fees, active addresses, TVL, developer activity, retention, and security.

Plan defensibility – protocols: credible neutrality, uptime, integrations; apps: UX speed, brand, partnerships, data off-chain that adds switching costs.

Stage risk – start as a thin app on existing protocols; become a protocol only if shared state yields clear externalities and you can secure it.

Token ≠ value – speculation can decouple price from usage; insist on fee flows and durable demand.

Forkability – “fatness” can invite forks; if a protocol captures too much rent, users can migrate to cheaper variants.

Shifting theses – later cycles showed cases for thin applications and even fat wallets capturing user surplus and order flow; don’t treat “fat protocols” as a law.

Regulatory and MEV risks – value at the base can be taxed by regulation or extracted in the stack; design around these frictions.

Composability debt – integrations multiply attack surface; security and upgrade paths must be first-class.