Leverage

General usage (mechanics → finance → modern “force multipliers”)

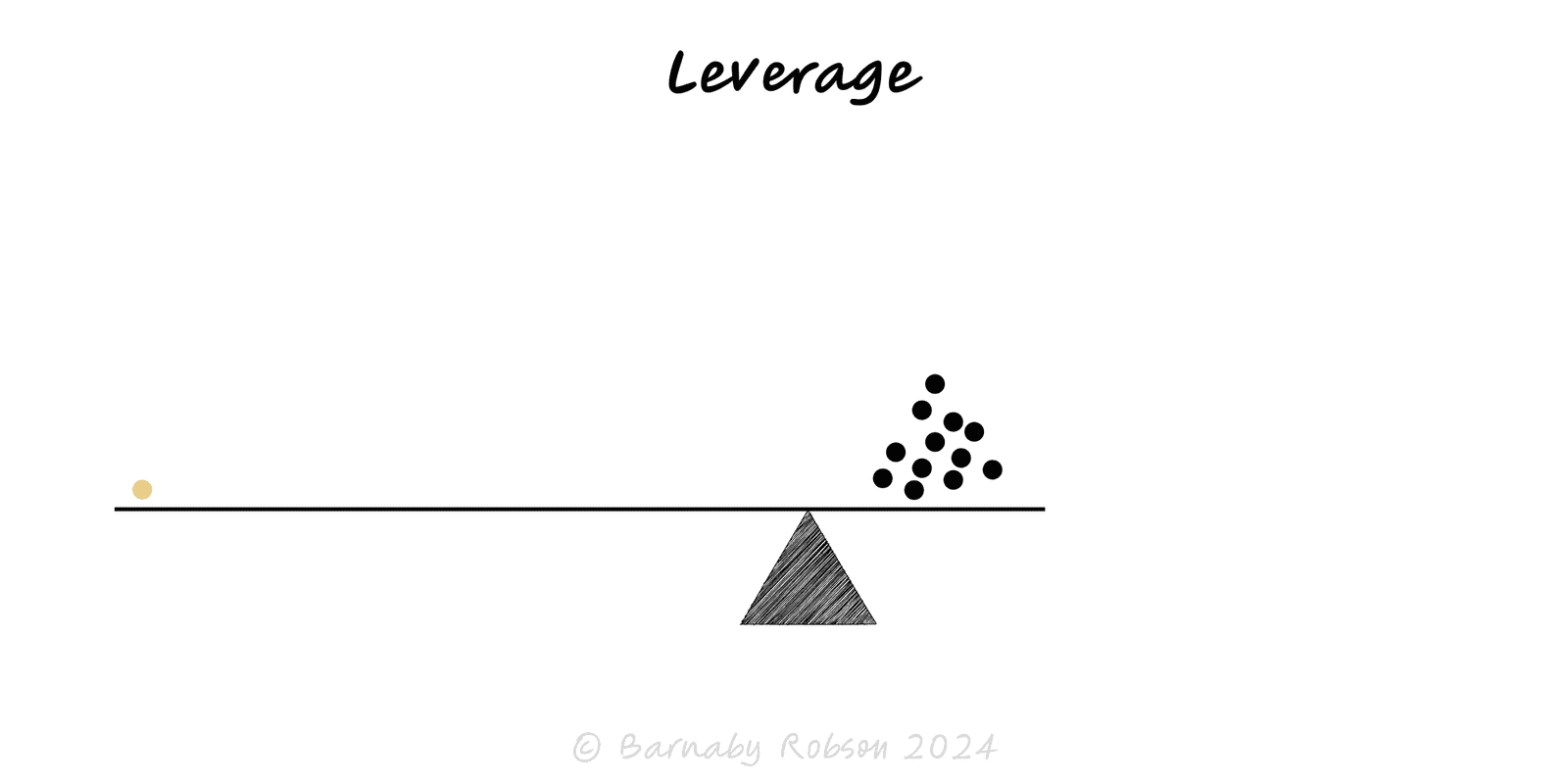

Leverage is any mechanism that lets one unit of effort produce more than one unit of result. The original metaphor is the physical lever; in business the common forms are financial (debt), operating (fixed-cost heavy models), and permissionless leverage such as code and media that scale without proportional headcount. The craft is to choose high-upside, bounded-downside leverage and size it prudently.

Operating leverage – more fixed costs (software, plant, content) mean profit rises quickly after break-even.

- Degree of operating leverage (at a point): DOL = Contribution / Operating profit.

Financial leverage – borrow to increase the equity holder’s exposure.

- Simple intuition: if ROA > interest rate, debt lifts ROE; if not, it drags it.

Distribution leverage – partnerships, platforms, SEO, marketplaces that multiply reach.

Code & media – software and content scale with near-zero marginal cost (“build once, run many”).

Process & automation – checklists, SOPs, and bots that let one person do the work of many.

Compounders – flywheels and networks increase leverage over time as effects reinforce.

Startups – ship software and content that work while you sleep; integrate into existing platforms for reach.

Sales & GTM – ecosystems, affiliates, app stores, OEM deals.

Ops – automation, self-serve workflows, templates, and shared services.

Finance – sensible debt for assets with stable cash flows; project finance with ring-fenced risk.

Personal – writing, tooling, and frameworks that keep paying off.

Pick the amplifier – capital, code, media, distribution, or process.

Model the payoff – where does output scale sub-linearly with added input? what is the break-even and marginal ROI?

Bound the downside – use limited-recourse structures, caps, SLAs, circuit breakers, and small reversible tests.

Right-size exposure – set position limits (debt ratios, spend caps, concurrency), and target DOL that you can support through downturns.

Sequence leverage – earn operating leverage first (repeatable demand), then add financial leverage if cashflows are robust.

Instrument – track unit economics, contribution margin, utilisation, cash runway, covenant headroom; review monthly.

Compound – reinvest gains to deepen the moat (automation, content libraries, distribution deals).

Ruin risk – leverage multiplies volatility; a few bad periods can wipe out equity (margin calls, covenant breaches).

Premature fixed costs – high operating leverage before product–market fit raises break-even and burn.

Single-channel dependence – platform or partner policy changes remove your “free” distribution.

Brittle automation – silent failures at scale; add monitoring and manual escape hatches.

Debt without duration match – short-term funding for long-term assets creates refinancing risk.

Confusing motion with leverage – busywork that doesn’t increase slope is not leverage.