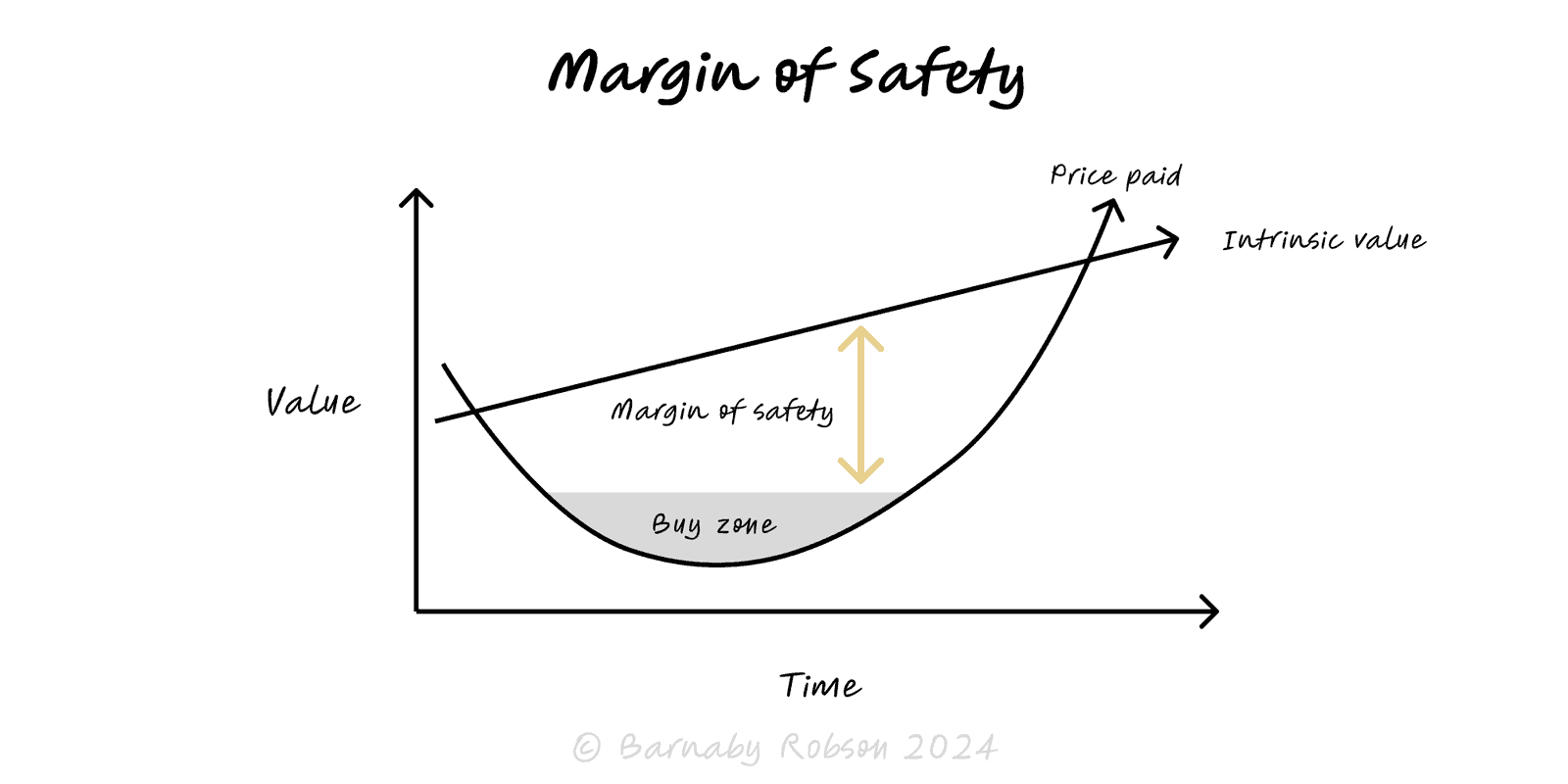

Margin of Safety

Benjamin Graham (investing); adopted by Warren Buffett & Charlie Munger. Engineering origin in safety factors.

A margin of safety (MoS) is a buffer between what you have and what you need.

In investing, pay a price well below intrinsic value so estimation errors and shocks don’t destroy capital.

In engineering/ops, design capacity above expected load (a safety factor) so systems stay safe under stress.

It’s a universal rule for action under uncertainty: protect against model error, variance, and tails before chasing upside.

Investing version

- Intrinsic value (IV) vs Price (P).

- MoS (currency) = IV − P.

- MoS (%) = (IV − P) ÷ IV. Use larger MoS when quality is uncertain or cyclicality/tail risk is high.

Engineering/ops version

- Safety Factor (SF) = Capacity ÷ Expected Load.

- Safety Margin (%) = (Capacity − Load) ÷ Capacity. Choose SF based on variability, consequences of failure, and detection/response time.

Portfolio & bets

- Size exposure below theoretical optima (e.g., half-Kelly) to survive drawdowns and correlation spikes.

Planning

- Add time/cost buffers where variance concentrates (bottlenecks, long lead items), not everywhere.

Public/private investing – cyclicals, turnarounds, illiquid assets; concentrate only when MoS is demonstrably large.

Product & capacity – headroom on servers, queues, and fulfilment; surge tolerance.

SRE & safety – rate limits, circuit breakers, redundancy (N+1/2N).

Liquidity management – cash runway, covenant headroom, diversified credit lines.

Project management – schedule buffers and scope guards around risky milestones.

Quantify the need

Investing: conservative IV from multiple methods (DCF ranges, comps, unit economics).

Ops: expected peak load (p95/p99), variability, single-point failure analysis.

Set the buffer rule

Investing MoS guideline: favour ≥ 30–40 percent gap for average quality; ≥ 50 percent for uncertain or cyclical cases.

Ops SF guideline: start at 1.2–2.0× depending on uncertainty and failure severity; higher where detection is slow or blast radius is large.

Design to the worst-plausible, not the mean

Use percentiles (p95/p99), scenario bands, and tail checks rather than averages.

Prefer convexity

Cap downside (limits, stop rules, ring-fencing) and keep some cheap upside exposure (options, small probes).

Place buffers surgically

Protect the constraint and one-way doors; avoid padding every step.

Review and resize

Re-estimate value/load as facts change; trim or add MoS with evidence.

False precision – tight buffers against shaky estimates; treat IV and loads as ranges.

Over-conservatism – MoS so large you never act; pair with small reversible tests.

Bloat – padding everywhere slows flow and raises cost; buffer at bottlenecks and high-impact risks only.

Hidden correlation – “diversified” bets fail together in stress; test for common shocks.

Leverage + thin MoS – operating or financial leverage can erase buffers quickly; watch covenants and utilisation.

Erosion over time – creep in costs or load quietly consumes headroom; monitor p95/p99 and drift.