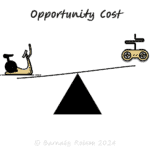

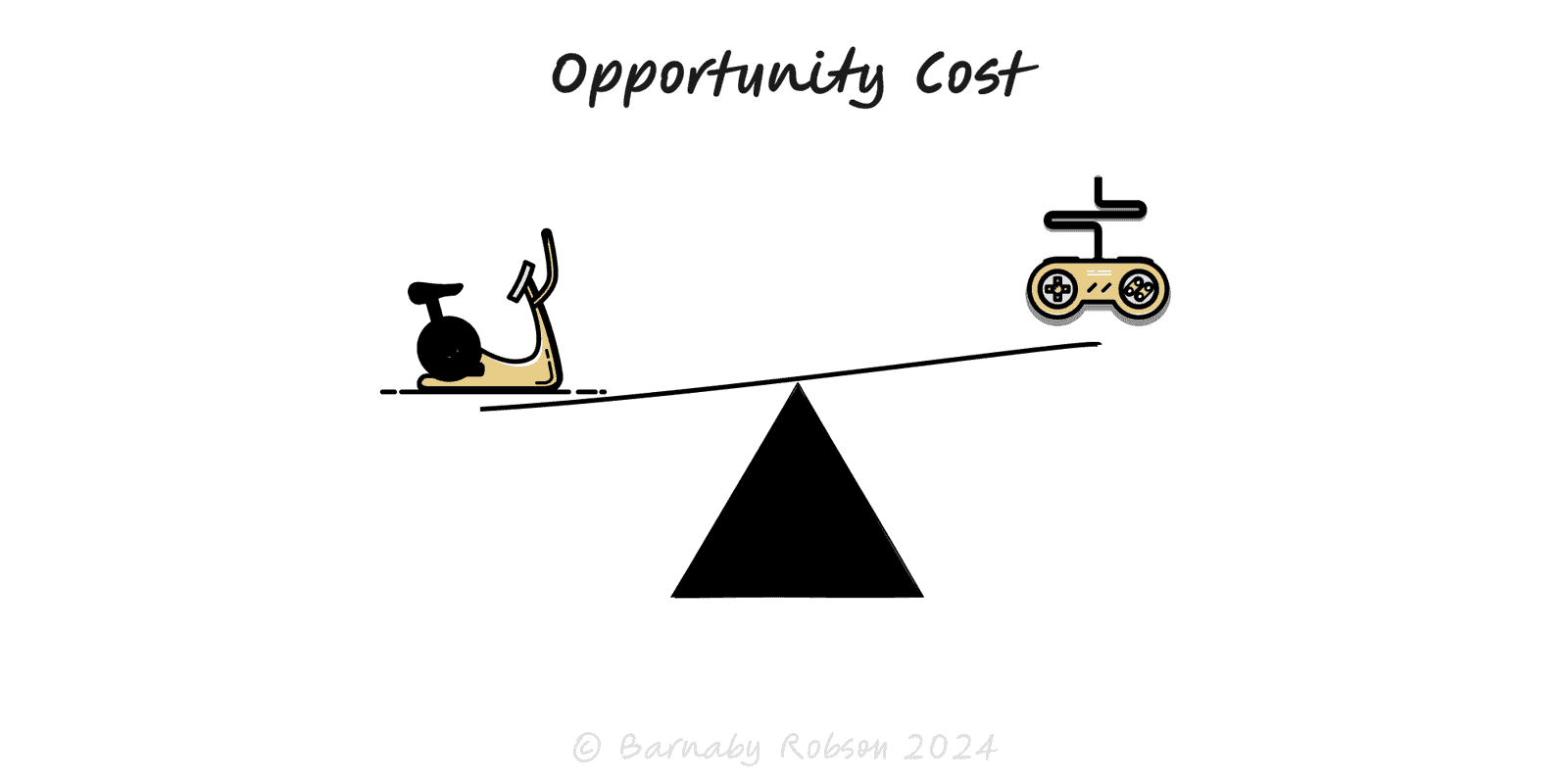

Opportunity Cost

Classical economics (Friedrich von Wieser; mainstream microeconomics)

Opportunity cost reframes decisions from “What does this option cost?” to “What am I giving up by choosing it?”. Because time, capital and attention are scarce, selecting one path excludes others. Sound choices compare options on a common basis (value, utility, ROI, joy) and focus on marginal differences, not averages or sunk costs.

Counterfactual – define the best thing you would do if you didn’t choose this option; that’s the benchmark.

Marginal, not total – compare Δbenefit − Δcost between options; ignore sunk costs.

Constrained resources – time, cash, capacity and optionality are scarce; choosing A consumes some or all of them.

Hidden costs – fatigue, complexity, lock-in and foregone learning are often the largest opportunity costs.

Relative advantage – even if you’re good at two things, do the one with the lower opportunity cost for you (ties to comparative advantage).

Capital allocation – project A vs buybacks vs debt paydown vs acquisition.

Product roadmap – what you don’t build this quarter.

Hiring & time – meetings, context switches, side projects; value of deep work.

Pricing & discounts – short-term volume vs long-term willingness to pay.

Career choices – role, location, equity vs cash, learning paths.

Operations – using scarce machines/teams on low-ROI work blocks higher-value jobs.

List real alternatives – include “do nothing” and the best use of time/capital you could choose instead.

Set a single yardstick – e.g., £NPV, contribution per hour, learning/option value; convert each option to that unit.

Compare at the margin – compute incremental benefit and cost vs the best alternative, not vs zero.

Price the intangibles – put rough £ or score ranges on risk, focus, speed, and option value.

Pick the winner & schedule the rest – choose the highest net value now; park others with review dates.

Revisit on new information – if the counterfactual improves (or constraints change), re-run the choice.

Sunk-cost fallacy – past spend/time is gone; decide on future incremental value.

Phantom alternatives – comparing against an option you wouldn’t actually execute.

Wrong unit – mixing cash, impact and vanity metrics; force a common yardstick.

Time blindness – ignoring delay costs; sometimes “good now” beats “great later”.

Lock-in – choices that kill future options can have a large opportunity cost; price optionality.

Over-optimising pennies – spending hours to save small costs while giving up high-value work.