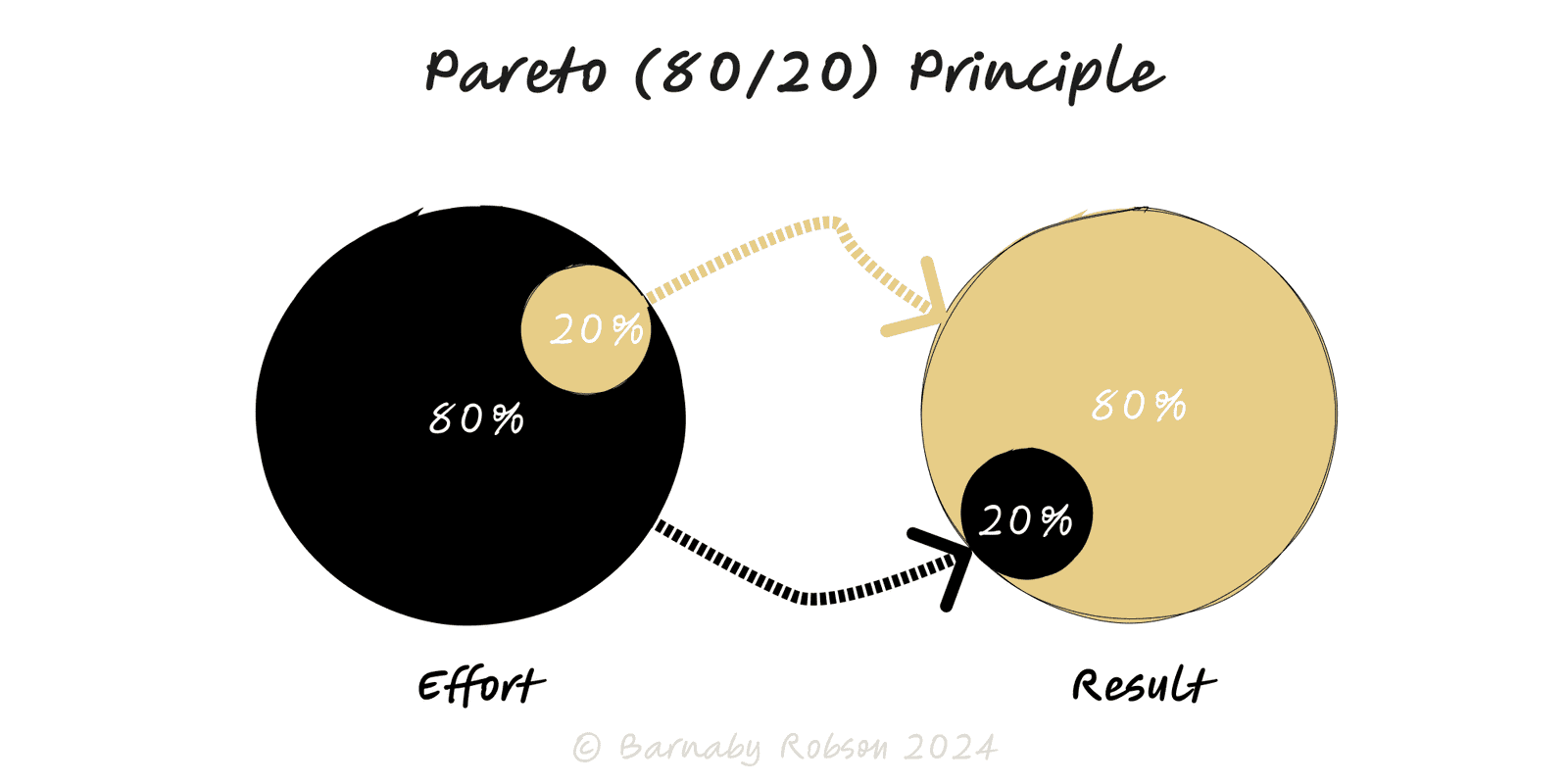

Pareto Principle (80/20)

Vilfredo Pareto (1896); generalised by Juran as the “vital few vs trivial many”

The Pareto Principle is a practical heuristic drawn from skewed (often heavy-tailed) distributions: results are unevenly concentrated. It’s not a law of nature and not always 80/20, but the pattern is common—few products → most revenue, few defects → most failures, few tasks → most impact. The move is to identify concentration, act on the top contributors, and design a sane policy for the long tail.

Skewed contribution – rank items by impact (descending); cumulative impact rises steeply then flattens.

80/20 is a placeholder – real cut-points might be 70/30, 90/10, 65/35—use your data.

Visuals –

- Pareto chart: bars (impact per item) + line (cumulative %).

- Lorenz curve: share of items vs share of outcome; bowing indicates inequality.

Why it appears – compounding effects, network/exposure differences, constraints, positive feedback, and variance.

Action logic – handle the vital few with disproportionate attention; standardise or batch the useful many; cap or drop the trivial tail.

Revenue & customers – top cohorts, SKUs, or channels drive most contribution.

Quality & reliability – few root causes explain most incidents/defects.

Product & UX – a handful of journeys/features create most value; simplify around them.

Growth & content – few pages/creators pull most traffic; optimise those first.

Inventory & procurement – ABC classification for stocking and vendor attention.

Personal effectiveness – identify tasks/meetings that actually move outcomes.

Define the outcome – revenue, failures, time, adoption, cost.

Collect and rank – list items (SKUs, causes, tasks) with measured impact; sort high → low.

Plot a Pareto chart – add cumulative %; mark where the curve bends (natural threshold).

Choose cut-offs – e.g., A (top ~10–20 percent of items) → high attention; B (next ~30 percent) → standard playbook; C (rest) → automate, cap, or prune.

Act on the vital few – bespoke fixes, premium SLAs, targeted experiments, root-cause elimination.

Set tail policy – minimum service levels, self-serve only, or discontinuation.

Review cadence – re-run monthly/quarterly; watch for drift as mix and seasonality change.

Worshipping 80/20 – use your distribution; don’t force the ratio.

Mean vs margin – optimise incremental ROI, not just biggest bars historically.

Tail blindness – small items may be strategic (emerging segments, reliability hotspots).

Goodhart risk – if you pay only on the top slice, gaming and neglect follow; add guardrails.

Stale rankings – today’s A-items can decay; keep the chart live.

Correlation ≠ cause – big bars show where to look, not why it happens.