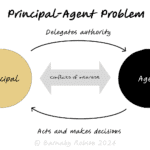

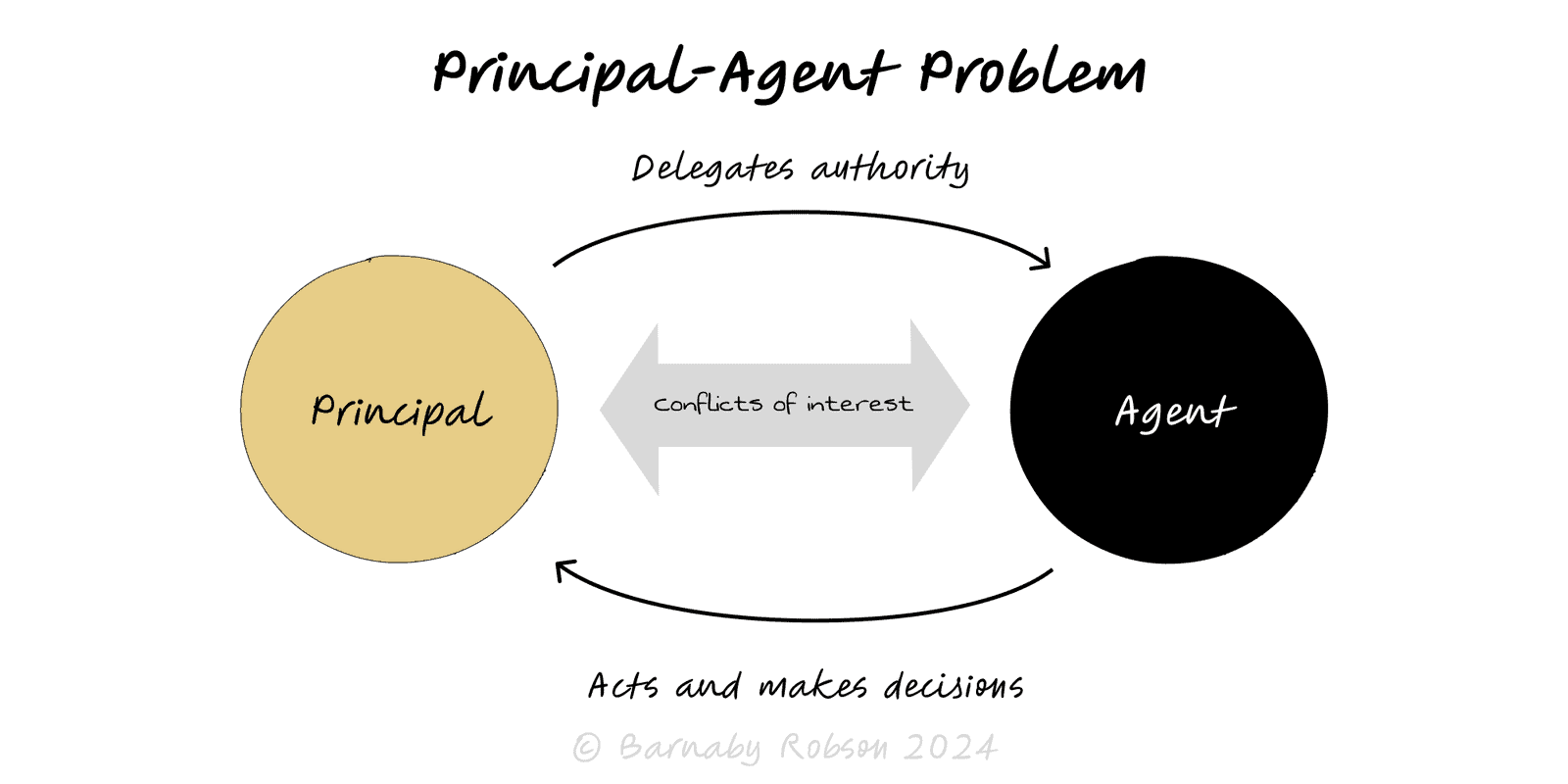

Principal-Agent Problem

Economics/contract theory (Jensen–Meckling; Akerlof; Holmström)

This shows up any time one party acts on another’s behalf — executives for shareholders, sales reps for a firm, contractors for clients. Agents know more about their actions than principals do, and they optimise for their own payoff. The model gives simple levers to close that gap: incentives, visibility, risk-sharing, and selection.

Different goals – pay, status, workload vs long-term firm value.

Information gaps – agent effort/quality is hard to observe.

Hidden action – risk-taking or shirking after the deal (moral hazard).

Hidden info – weak agents/projects select into rich terms (adverse selection).

Horizon & risk mismatch – short bonuses vs long outcomes; agents bear undiversified risk.

Metric distortion – pay one KPI, get that KPI (and collateral damage).

Executive & sales compensation – equity/vesting, quota design, clawbacks.

Asset management – GP–LP fees, carry, high-water marks, hurdles.

Franchising & platforms – brand standards, audits, rating systems.

Outsourcing/procurement – SLAs, penalties/bonuses, termination rights.

Insurance & lending – deductibles, covenants, monitoring.

M&A integration – earn-outs, retention and founder handover risk.

Public sector – contractor incentives vs service quality; PPPs.

Define the true outcome you want (not just a proxy metric).

Map what the agent controls and what you can observe.

Pick pay mix – fixed vs variable; tie variable to outcomes you can verify; add deferral/clawback where needed.

Add visibility – SLAs, sampling, audits, customer scores; fewer, clearer measures.

Align horizon & risk – vesting/hold rules, caps/floors, co-investment.

Select well – references, trials, reputation signals; avoid adverse selection.

Review and iterate – watch for gaming; adjust metrics and rules.

Paying the proxy – targets hit, mission missed (Goodhart).

Short-termism – annual bonuses that burn long-term value.

All-variable or all-fixed pay – misaligned risk sharing; mix matters.

One-metric comp – multitasking distortion; include quality/satisfaction/sustainability.

Over-monitoring – kills autonomy and intrinsic motivation; use trust + verification.

Adverse selection via rich terms – the wrong agents self-select into your scheme.