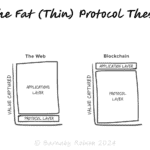

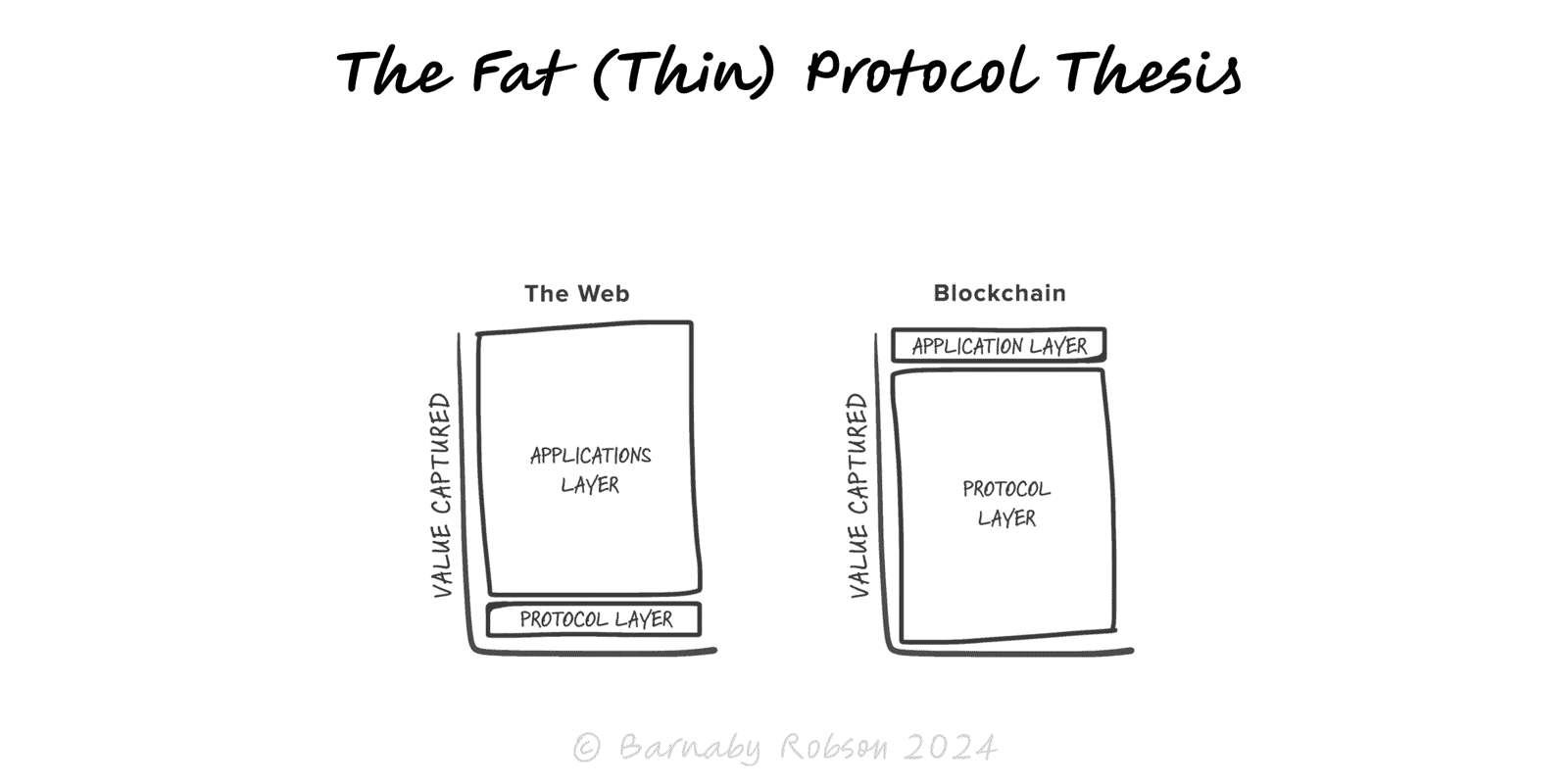

The Fat (Thin) protocol Thesis

Joel Monegro (USV)

In blockchains, value tends to concentrate at the shared protocol layer rather than the application layer, though modular stacks and wallets can shift where value accrues.

Shared state + token sinks – demand for blockspace and security accrues to the base token via fees/burn/staking, concentrating value at the protocol.

Open composability – reusable primitives reduce app moats; value gravitates to common infrastructure layers.

Network effects at the base – liquidity, security, and developer ecosystems compound at L1/L2 layers.

Speculation as bootstrap – tokens price potential network effects early, amplifying protocol market caps vs young apps.

Venture and token selection – locate where value will be captured in a given stack (L1, L2, DA layer, wallet, or app).

Product strategy – decide whether to build defensibility as a protocol primitive or an application with distribution advantages.

Fee and governance design – evaluate token sinks, fee flows, MEV capture, and value sharing to apps.

Modular stacks – assess how shared sequencers, DA layers, and intent/wallet routing reallocate value.

Map the stack – execution (L1/L2), data availability, sequencing, wallet/intent, and app layers.

Trace value paths – fees, issuance, burns, staking rewards, MEV, revenue shares to apps.

Test app defensibility – distribution, switching costs, data moats, brand; don’t assume apps are “thin”.

Stress test modularity – ask how new DA layers, shared sequencers, or wallet UX could shift capture.

Position – invest/build where capture mechanisms are strongest and durable.

Determinism – the thesis is an observation, not a law; cycles can favour “fat apps” or fat wallets.

Speculative misread – high token prices can reflect hype, not sustainable capture.

Ignoring wallets/UX – control of distribution and order flow at the edge can capture outsized value.

Layer slippage – modular architectures may redistribute value from L1s to L2s/DA layers and clients.